Centrelink Payment Appeal Process: A Complete Guide (2025-2026)

If you’ve recently received a decision from Centrelink that you disagree with, you may be wondering how to challenge it. Understanding the Centrelink payment appeal process is crucial to ensuring your rights are upheld and that you receive the correct benefits. In this comprehensive guide, we will walk you through the steps involved in appealing a Centrelink decision, offer advice on getting legal support, and provide up-to-date information relevant to 2025-2026.

Table of Contents

What is the Centrelink Payment Appeal Process?

The Centrelink payment appeal process is a legal mechanism that allows individuals to contest decisions made by Centrelink regarding their eligibility for payments, allowances, or services. This process is designed to ensure that decisions are fair, transparent, and in line with the laws governing social security benefits in Australia.

Why Might You Need to Appeal a Centrelink Decision?

There are various reasons why you might want to appeal a Centrelink decision. These include:

- Denial of a claim for payments like JobSeeker, Family Tax Benefit, or Disability Support Pension.

- Suspension or cancellation of ongoing benefits.

- Incorrect payment rates or delays in receiving benefits.

- Disagreements over child support decisions or other Centrelink-related matters.

It’s important to note that challenging a Centrelink decision is a formal process, and you must follow specific steps to have your case reviewed.

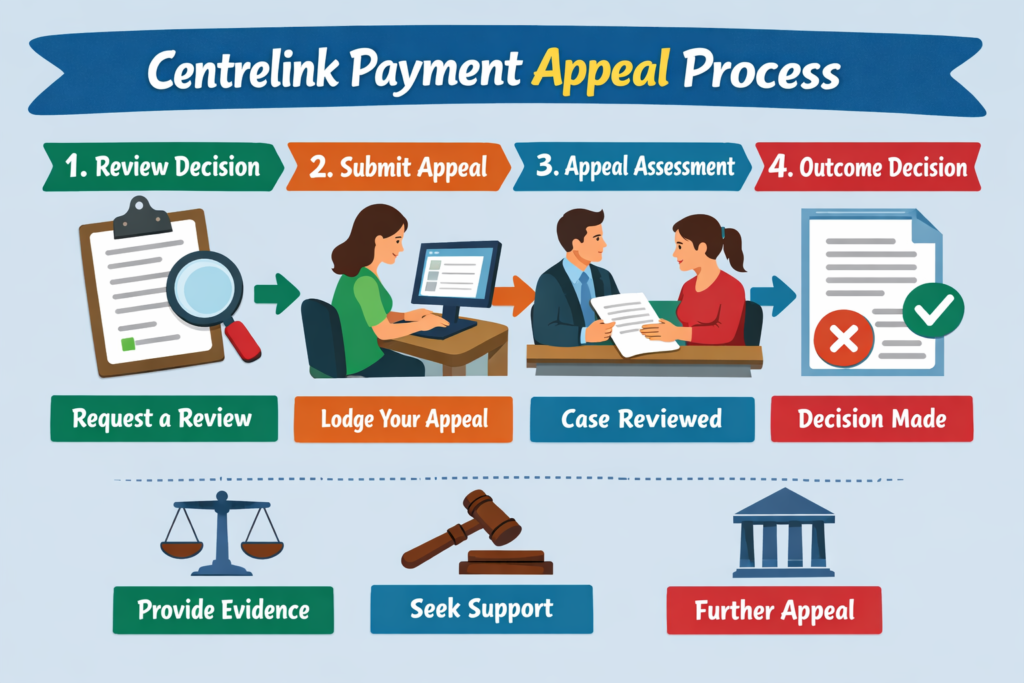

Step-by-Step Guide to the Centrelink Payment Appeal Process

Understanding the appeal process is essential to navigating your rights effectively. Below is a detailed breakdown of the steps you will need to follow if you want to challenge a Centrelink decision in 2025-2026.

1. Requesting an Explanation or Informal Review

The first step in the appeal process is to request an explanation of the decision from Centrelink. This can often clarify the reasons for the decision and provide insights into what went wrong. If you believe that the decision was incorrect, you can ask for an informal review by the original decision-maker.

Key Points:

- You can request an explanation through your myGov account or by contacting Centrelink directly.

- If you don’t agree with the explanation, you can move on to a formal review.

2. Internal Review by an Authorised Review Officer (ARO)

If the informal review does not resolve the issue, you can apply for an internal review. This is conducted by an Authorised Review Officer (ARO). The ARO will review your case and make a final decision based on the available evidence. This review is important because it’s an opportunity to challenge the decision internally before moving on to external options.

Important Considerations:

- You must apply for this review within 13 weeks from the date of the decision.

- The ARO will provide a written explanation of their decision, and if they uphold the original decision, you can still appeal externally.

3. External Review by the Administrative Appeals Tribunal (AAT)

If you’re dissatisfied with the outcome of the internal review, your next step is an external review by the Administrative Appeals Tribunal (AAT). This independent body assesses Centrelink decisions to ensure fairness. There are two main divisions of the AAT you may need to deal with:

- Social Security Division (AAT1): Deals with appeals related to social security payments.

- General Division (AAT2): Handles more complex cases.

Steps for AAT Review:

- Apply for an appeal to the AAT online or by submitting a form.

- Submit supporting evidence to help your case.

- Attend a hearing (either in person or over the phone) if necessary.

The AAT will assess whether Centrelink made an error and can either confirm the original decision, change it, or make a new decision.

4. Appealing to the Social Security Appeals Tribunal (SSAT)

For cases involving Family Tax Benefit or child support matters, the Social Security Appeals Tribunal (SSAT) may be the appropriate body. The SSAT provides an alternative avenue for those who wish to appeal Centrelink’s decision on family assistance or child-related payments.

5. Requesting an Extension of Time for Your Appeal

Sometimes, due to personal circumstances, you may not be able to meet the deadlines for appealing. In such cases, you can request an extension of time from Centrelink or the AAT. However, extensions are not always granted, and you must have a valid reason for why you were unable to meet the initial deadline.

6. Final Appeal to the Federal Court

In rare cases where you are still dissatisfied with the AAT’s decision, you may be able to take the matter to the Federal Court of Australia. This step is usually only pursued if there is a significant error in law. Seeking legal advice is essential if you are considering this route.

Key Considerations in the Centrelink Payment Appeal Process

Navigating the appeal process can be daunting, but understanding the important aspects can help ensure a smoother experience.

1. Time Limits

Be mindful of the time limits for each stage of the appeal process. For internal reviews, you generally have 13 weeks to apply, and there are strict timelines for AAT and SSAT appeals. If you miss these deadlines, you risk losing the opportunity to appeal.

2. Supporting Evidence

When appealing, evidence is key. Ensure you gather all relevant documents, such as pay slips, medical certificates, or other official records that can support your case. Clear and detailed evidence can make a significant difference in the outcome of your appeal.

3. Legal Assistance

If you are unsure about the appeal process or need assistance with your case, you may want to seek legal advice. Legal aid services, such as Victoria Legal Aid or Social Security Rights Victoria, can provide free legal support to help guide you through the appeal process.

4. Representation in Appeals

You can represent yourself during the appeal process, but you are also allowed to have someone act on your behalf. This can be a family member, a friend, or a lawyer. Having proper representation can make the process easier to manage, especially if you are unfamiliar with the legal jargon.

5. Interpreter Services

If English is not your first language, you can access interpreter services at any stage of the appeal process. Centrelink offers these services free of charge to ensure that all individuals have equal access to the review and appeal process.

What to Do if You’re Successful in Your Appeal?

If your appeal is successful, Centrelink will reverse or alter the original decision. This could mean:

- Back payments of any benefits that were wrongly denied.

- Adjustments to the payment rate if the original decision was incorrect.

If the outcome is favourable, you can also request a pause on any debt repayments during the review process.

Conclusion

The Centrelink payment appeal process is a crucial avenue for ensuring that decisions made by Centrelink are fair and accurate. While the process may seem complex, following the outlined steps and understanding your rights will help you successfully navigate it. From requesting an explanation to appealing to the AAT or SSAT, you have multiple opportunities to challenge decisions. Always ensure that you act within the designated time limits and gather strong supporting evidence for your case.

Remember, if you need assistance, there are numerous support services available, including legal aid and interpreter services, to help you through the process. With the right guidance and approach, you can challenge Centrelink’s decisions and ensure you receive the correct benefits you are entitled to.

1. What is the Centrelink Payment Appeal Process?

The Centrelink payment appeal process allows individuals to challenge a decision made by Centrelink regarding social security payments. It involves requesting an explanation, seeking an internal review, and possibly appealing to external bodies like the AAT or SSAT if the initial review does not resolve the issue.

2. How do I start the Centrelink payment appeal process?

To begin the Centrelink payment appeal process, you must first request an explanation of the decision. If you’re not satisfied, you can apply for an internal review by an Authorised Review Officer (ARO) or proceed to external reviews by bodies such as the AAT or SSAT.

3. What are the steps involved in appealing a Centrelink decision?

The main steps in appealing a Centrelink decision are:

Request an explanation or informal review.

Apply for an internal review by an ARO.

If the internal review is unsatisfactory, appeal to the AAT or SSAT.

As a final option, consider appealing to the Federal Court if legal errors are involved.

4. How long do I have to file an appeal after a Centrelink decision?

You typically have 13 weeks from the date of the decision to apply for an internal review. For appeals to the AAT or SSAT, you generally have 28 days from the date of the internal review decision.

5. Can I get help with my Centrelink appeal?

Yes, you can get help with your Centrelink appeal from legal aid services, such as Victoria Legal Aid or Social Security Rights Victoria. Additionally, Centrelink provides interpreter services if English is not your first language.

6. Can I appeal a Centrelink decision about Family Tax Benefit or Child Support?

Yes, if the decision involves Family Tax Benefit or child support, you can appeal through the Social Security Appeals Tribunal (SSAT), which specifically handles family assistance and child support matters.

7. What documents do I need for a Centrelink appeal?

You will need supporting documents such as pay slips, medical certificates, correspondence with Centrelink, and any other records relevant to your case. Strong evidence is essential to support your appeal.

8. How do I request an extension for my appeal?

If you cannot meet the appeal deadline, you can request an extension from Centrelink or the AAT. However, extensions are granted only if you provide valid reasons for why you missed the deadline.

9. What happens if my Centrelink appeal is successful?

If your Centrelink appeal is successful, the original decision will be overturned or altered. This could result in back payments or an adjustment to your payment rate.

10. Can I represent myself during a Centrelink appeal?

Yes, you can represent yourself during the appeal process. However, you also have the option to appoint a representative, such as a lawyer, family member, or friend, to help you navigate the process.